Chairman’s Letter

“The results reflect the careful and strategic decisions made over the years, the strengths we have built through strong customer relationships, investments in technology and our exceptional team.”

GRI 102-14

It is my pleasure, on behalf of the Board of Directors, to present to you the Annual Report of CDB for the financial year ended 31 March 2021.

A resilient organisation

The COVID-19 pandemic has left us facing economic and social upheaval on a scale unseen in the history of our existence. It has altered the landscape for all of us, severely impacting our customers, our team, our shareholders and the communities we serve. Even as I write this, the pandemic is still shaping the environment and our behaviour, although to some extent we have begun to better understand its contours today. On behalf of CDB, I wish to extend our deep gratitude to the selfless commitment to duty by our frontliners - healthcare service personnel, members of the triforces and the Sri Lanka Police as they work tirelessly to bring the pandemic under control in our Nation.

The pandemic is not the first dislocation we have faced in our 25 years of operations. Characteristically, our Company and our people responded once again with resolve, confidence and skill. Although the pandemic has had a profound impact on the workplace and the way we interact with customers, it has not changed our commitment to our customers, nor the standards they hold us to. Our prudent approach to sustainability and growth through proactive responses to the crisis ensured our resilience on all fronts; our business, our culture and our morale.

I am extremely proud of our management team and staff for their professionalism, dedication and the exceptional way they responded to challenging circumstances. They went over and above to support our customers, communities, and one another, while working to deliver for our shareholders. The Board of Directors was engaged, working closely with management throughout the year. The results reflect the careful and strategic decisions made over the years, the strengths we have built through strong customer relationships, investments in technology and our exceptional team.

Ready for the future

Leveraging our pre-crisis strength and momentum, and our investments in pursuit of a digitally enabled organisation, we continued to propel our business forward. Our investments in technology that encompasses many functions, is driving efficiency, supporting innovative ways of working and delivering the convenience and simplicity that customers tend to value most today. In response to the pandemic, our team members transitioned almost overnight to working from home, again backed by resilience and adaptability of our digital infrastructure. Having embarked on the path of automation and digitalisation ahead of the curve enabled us to reap the benefits, especially as pandemic related restrictions accelerated migration to digital processes and services by both consumers and businesses. Our Robotic Process Automation (RPA), which was recognised with an Award for Excellence in Automation 2020 at the UiPath Automation Excellence Awards for the Indian and South Asian regions is transforming how we work and prepared us to operate in a crisis situation. We will continue with our aim to disrupt traditional norms in the financial services industry, innovate pioneering solutions that push towards a cashless society, improve financial inclusion and support a digitalised and sustainable Sri Lanka.

Challenging operating context

In tandem with the pandemic induced global economic downturn, the Sri Lankan economy contracted in 2020, recording the deepest recession since independence. Real economic activity was hampered across all sectors on account of mobility restrictions and other containment measures imposed locally and internationally, to curtail the spread of COVID-19.

Amidst challenging domestic and global market conditions, the stability of Sri Lanka’s financial system was preserved. The CBSL demonstrated a steady hand, taking several regulatory actions such as relaxing regulatory requirement for liquid assets from 10% to 6% which helped to maintain the stability of the sector when the general levels of anxiety were high.

39%

increase in profit after tax to Rs. 2,557 Mn. for the year under review

We will enhance our digital capabilities to improve customer experience, strengthen our internal processes, enable businesses to succeed and support Sri Lanka’s economic recovery.

Delivering for our stakeholders

Long before COVID-19 was declared a pandemic by the World Health Organisation (WHO), we were quick to respond to mitigate any potential impact. Our agility and proactive decision making helped to keep our team, their families, and customers healthy and safe, honour our commitments to stakeholders and ensure continuity of our business operations.

We supported our customers to navigate the economic headwinds and stay in control of their finances. We actively participated in CBSL’s debt moratorium programs and such moratoriums on loans were extended to over 90,000 customers. As elaborated in the CFO's Analysis however, our efforts went beyond compliance with CBSL programs by working closely with our clients on a case by case basis, assisting them to tide over and regain their business. We also catered to the unprecedented demand for digital financial solutions by extending uninterrupted access to our mobile and digital platforms, enabling customers to gain functionality, user experience and utility.

We have made a mark of raising the bar for Sri Lanka’s corporate sector, having interwoven sustainability into our corporate strategy. Ranked among the Top 10 Best Corporate Citizens for three consecutive years, awarded by the Ceylon Chamber of Commerce, is a strong testament to the successful efforts of our Company to synchronise economic, social and environmental sustainability. As a net lender to the rural economy, we enrich rural entrepreneurship and uplift rural financial strength, addressing inequalities, social exclusion and marginalisation of various population groups. This includes, in particular, our commitment to supporting the SME sector and the empowerment of women entrepreneurs. We were also ranked among top 25 businesses in the Business Today Top 30 Businesses in Sri Lanka and we won Bronze at the Best Service Brand of the year awards of SLIM Brands Excellence Awards 2020; the only Banking and Finance Sector institution to achieve this during the year. Our contribution to economic growth in the form of taxes and levies to the Government Treasury during the year under review amounted to Rs. 1,922 Mn. We also continued to support our people’s safety, health and wellbeing, and professional development, ensure their job security and actively reward and celebrate their achievements.

The year 2020 was a milestone year for CDB. Your company celebrated its 25th year and has every reason to be proud of what it has achieved. I would like to direct you to the CEO’s review for a first hand recount of this remarkable and inspiring journey. Today, CDB is the fifth largest NBFI and has seen its assets grow close to 10 fold and its net profits grow over 10 fold in the last decade. Importantly, it’s the same management team who strategized, planned and executed remarkably well to build this business from scratch that is still at the helm. They have a deep and intimate knowledge of the business. This gives me confidence that CDB is well equipped to execute on the ambitious plans set out for ourselves.

We have made a mark of raising the bar for Sri Lanka’s corporate sector, having interwoven sustainability into our corporate strategy.

Over the years, your Company has maintained an attractive and consistent record of dividend payments, keeping with its growth in profitability. I am pleased to announce that the Board has recommended a dividend of Rs. 7.50 per share for the year under review.

The Board of Directors approved an Employee Share Option Plan (ESOP) for which the market announcement was made in April. We await the approval of shareholders for this by way of a special resolution at the Annual General Meeting. This is the first time an ESOP has been proposed by the Company since its listing on the Colombo Stock Exchange in 2010.

A commendable performance

Your Company reported a commendable performance for financial year 2020/2021 demonstrating the resilience of our business model and the robustness of our governance and risk management frameworks. The profit after tax increased by 39% to Rs. 2,557 Mn. for the year under review, while Earnings Per Share increased to Rs. 36.64 from Rs. 26.32 a year ago. Again, I would direct you to the CEO’s review for a more detailed commentary on CDB’s performance.

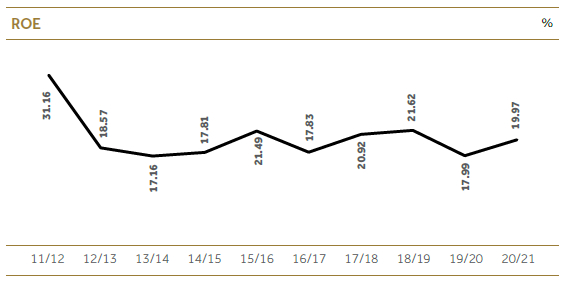

The consistent improvement in our capital adequacy ratios over the past several years enabled us to be in a comfortable position in meeting even higher capital adequacy requirements stipulated under guidelines on the Sector Consolidation and the Prompt Corrective Action of the Central Bank of Sri Lanka. In the year under review, our Return on Average Equity was 19.97% which is commendable. Our Core Capital Ratio and Total Capital Ratio stood at 12.10% and 15.34% respectively as at 31 March 2021.

Strong governance

The Board remained committed towards pursuing excellence in corporate governance and risk management oversight. We have a strong governance structure with a healthy mix of executive and non-executive directors on the Board. We continued to strengthen risk management, particularly in the area of cyber security with a focus on our internal controls, policies and procedures. The Board is strongly committed to safeguarding the trust placed in CDB as a leading financial institution in Sri Lanka. We continue to be fully compliant with all regulations, especially pertaining to operations during the pandemic.

The year ahead

We will enhance our digital capabilities to improve customer experience, strengthen our internal processes, enable businesses to succeed and support Sri Lanka’s economic recovery. CDB has set itself an ambitious plan to become a quarter trillion (Q-TAB) company by expanding our balance sheet to Rs. 250 billion by 2030. Our immediate focus and tireless effort will be aimed at the intermediate milestones on our path to the Q-TAB goal. To achieve this, we will focus on onboarding customers, transaction volumes and fulfilling the aspirations of all customers through a wider product suite including conventional and check-in products.

Difficult times bring out the best in people and we have seen that to be true, time and again. Over the past year, we have faced a profound crisis with courage, conviction, and resilience and I remain optimistic about what lies ahead for your Company. It is our fundamental resilience, reinforced by our team members and their steadfast support for our customers, that gives me great confidence in the future.

“Our investments in technology that encompasses many functions, is driving efficiency, supporting innovative ways of working and delivering the convenience and

simplicity that customers tend to value most today.”

19.97%

Return on Average Equity

15.34%

Total Capital Ratio

Grateful appreciation

As I assume my position as Chairman of CDB, I wish to extend my sincere gratitude to Mr Ranga Abeynayake, the former Chairman who stepped down upon completing nine years on the Board, and under whose visionary leadership your Company navigated unprecedented times. I warmly welcome our newest Directors who joined the Board during the year under review: Mr Elangovan Karthik, Mrs Rajitha Perera, Mr Sujeewa Kumarapperuma, Mr Samitha Hemachandra and Prof Prasadini Gamage who add tremendous depth, diverse expertise and experience to our Board. My sincere thanks is extended to our outgoing Directors who also stepped down upon reaching the age of 70 or completing their nine year term as per Corporate Governance; Mr Razik Mohamed, Mr P A J Jayawardena and Prof Ajantha Dharnasiri respectively for their many contributions to our Organisation during their time on our Board and I'm sure you will join us in wishing all of them the very best in their future endeavours. I wish to convey my deep appreciation to my colleagues on the Board for the strong and consistent support, insightful guidance and the spirit of unanimity shown. I wish to commend Mr Mahesh Nananyakkara, our Managing Director and CEO for his inspired leadership, the management team and all staff members for their tremendous dedication and tireless efforts. I also extend my thanks to the senior officials of the Central Bank of Sri Lanka for their valuable counsel, guidance and support, and my appreciation to our Auditors, KPMG for their valuable advice and timely completion of the audit. My sincere appreciation is extended to our customers for their valued patronage and loyalty and our shareholders for their confidence and steadfast support extended to us at all times.

Alastair Corera

Chairman

10 June 2021