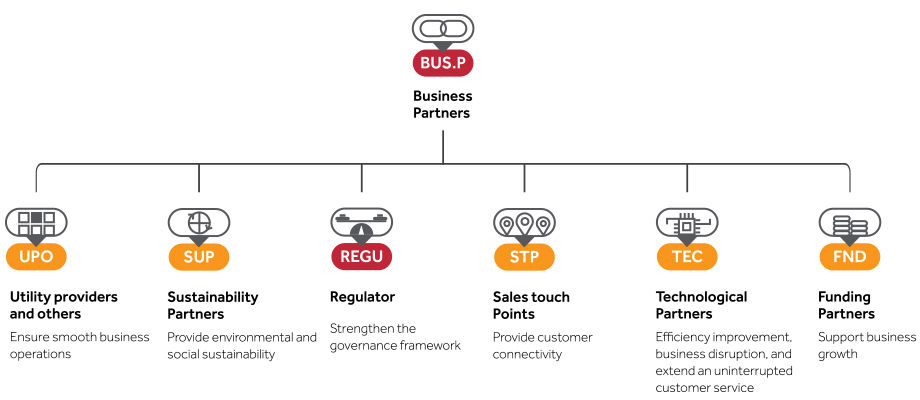

Business Partners

Our business partners

GRI 102-9, 102-10, 308-1

Selecting our business partners

GRI 308-1

We have embedded ethical procuring practices to our procurement practices. Before initiating a relationship, it is mandatory for all the suppliers to be registered with us and complete the necessary background checks. Following management approval, the details of our suppliers and partners are closely evaluated. Regular evaluations are subsequently conducted as well. Priority is given to local suppliers provided they meet the required standards. The suppliers are selected by our Purchasing Committee, and validated according to transaction authorisation limits.

The following criteria is applied in the supplier and business partner selection process:

- Compliance to applicable laws and regulations

- Compliance to relevant certifications and standards

- Adherence to environmental and social specifications

- Quality standards

- Cost competitiveness

- Reliability

- On-time delivery

- Past performance

- Customer reviews

In the event of any supplier or business partner failing to meet their responsibilities of respecting human rights and honouring other sustainability requirements, we would consider termination of the relationships.

A sustainable supply chain

GRI 102-9, 102-10

Our business partners are an essential part of our supply chain who facilitate our value creation process and we build trusting relationships through regular engagement. This helps to create mutual benefits and ensure they are performing to our standards and conducting business to our expectations. Significant financial and reputational damage could occur if our supply chain is not resilient to events that affect our operations. Therefore, appropriate measures have been taken to ensure sustainability of our supply chain. We did not encounter any delays to date in our supply chains even following the pandemic due to the strong partner relationships. We continue to strengthen our relationships with our partners to deliver our services without any interruption to our customers. In turn, we deliver a high business partner experience by supporting our business partners by activating timely payments, remaining strongly committed to all our partner agreements and providing feedback to identify areas of improvement to enhance their services and products.

Responsible and sustainable financing

GRI 307-1

We manage the environmental and social risks when promoting new business opportunities. Responsible and inclusive financial services are offered to enable positive social and environmental development. This includes areas such as promoting environmental protection, social justice, and economic prosperity. We stand ahead of the curve with a considerable net lending position to the

rural economy.

We have nurtured long-term relationships with the following sustainability partners to make a positive contribution to the society and environment.

| Partner | Project |

| Bio Diversity Sri Lanka (BSL) | Environment conservation efforts |

| Green Links (Pvt) Ltd. | Paper and e-waste recycling |

| Sri Lanka Climate Fund | ISO 14064-1 2018 GHG verification |

| Sri Lanka Association for Child Development | Act Early for Autism project |

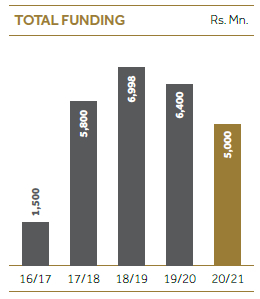

Funding partners supporting growth and expansion

Our funding partners support us by providing the required finances to expand our business, grow our balance sheet, and engage in elevating the aspirations of our stakeholders. Over the years, we have maintained long-standing relationships with both our local and international funding partners.

Since receiving our first foreign funding in 2013/14, we have built trust and confidence in our institution through stringent compliance, commitment to transparency, discharging of debt obligations in a timely manner, and business ethics. By channelling funds according to the respective mandates, we have contributed towards green financing that combats climate change, empowers women, and contributes to rural and SME development and agriculture expansion.

Transactions received from foreign funding partners.

| Funding partner | Year | Volume of funding |

| Belgian Investment Company for Developing Countries | 2013/14 2018/19 | USD 6 Mn. USD 10 Mn. |

| Nederlandse Financierings-Maatschappij Voor Ontwikkelingslanden N.V. | 2018/19 | USD 25 Mn. |

| BlueOrchard Micro Finance Fund | 2018/19 | USD 25 Mn. |

| Triodos Fair Share Fund & Triodos SICAV II | 2020/21 | EUR 5 Mn. |

Funding secured through our banking relationships with local funding partners.

Uninterrupted service through our technological partners

In tandem with our strategic priority of transformation from a FinTech to a TechFin Company, as a financial institution with a tech mindset in this decade, our technological partners will play a vital role in this process. Our technological partners support efficiency improvements and enriching customer experience. We have been working closely with a wide range of partners for our tech support. Especially following the COVID-19 pandemic, our strong and long-standing relationships with our technological partners enabled us to provide an uninterrupted service and meet the increased demand for digital services.

“We continued to support our business partners throughout the pandemic by activating timely payments, remaining strongly committed to all our partner agreements, and working diligently with our suppliers and external parties to continue our business operations.”

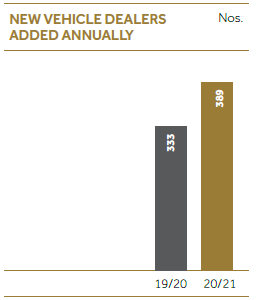

17%

growth in our dealer base grew YoY

Long-standing relationships with technological partners

Our partnership with sales touchpoints

Motor vehicle leasing is a key segment of our business, which constitutes a major portion of the lending business portfolio. Emphasising the importance of the strategic partnership with the vehicle dealers and principal agents, we have continued to nurture long-standing, cordial relationships with several vehicle suppliers across the country. They have supported customer connectivity resulting in the growth of our customer base and provision of value-added benefits to customers.

Growth in our dealer base

Our approach of expanding the vehicle dealer network through patpat dealer onboarding was prioritised during the year under review which enabled us to maintain the same momentum of adding new dealers. Even though the number of promotions conducted was impacted by the intermittent lockdown and restrictions of movement due to pandemic during the year, we were able to build up more productive and value added relationship compare to the competitors with the synergy of CDB lending strategy and patpat communication strategy

Support services ensuring smooth operations

There are several international and local partners who are vital for our business. We have outsourced operations, such as security, janitorial, logistics, courier, waste management, maintenance of office equipment, and machine servicing to specialist companies. This enables us to function smoothly and engage in daily business operations effectively. Most of these service providers are local. We engage with them regularly and recognise their efforts and services they provide. Through prompt payment for these services (electricity, water, telephone, and Internet services), we secure our relationship with them, together with reciprocal uninterrupted service. During the year 2020/21, Rs. 99 Mn. was paid to utility service providers.

Memberships and associations

GRI 102-13

We maintain membership of several industry organisations, professional institutes, associations and societies. Our active engagement in these forums helps us to enhance industry standards, enable networking, provide opportunities for employees to benefit from activities offered by these organisations, whilst contributing our best to resolve any industry issues. This is an ideal opportunity to build stronger relationships by engaging with our stakeholders.

Supporting our business partners through the pandemic

We continued to support our business partners throughout the pandemic by activating timely payments, remaining strongly committed to all our partner agreements and working diligently with our suppliers and external parties to continue our business operations. Arrangements were made to ensure all general payments were made without a delay for all the services received.

Future priorities

We will continue to prioritise contributing towards SDG 17 – Partnerships for the goals, and strengthen our relationships with business partners, securing mutual benefits and maximising the value delivered to our stakeholders. This will enable us to enhance our operational excellence by continuously elevating business partner experience and initiating new partnerships to create increased value.